The 2026 Budget proposes a tax increase of 11 percent, or 9.3 percent after factoring in annual growth to the tax base.

Last year’s increase was 3.8 percent. But this year, before anything else, the municipality is already committed to a 5 percent increase for the provincially mandated Asset Management Plan. That is non-negotiable.

That means all the other things in the budget have to come on top.

Meanwhile, negotiated increases in wages and benefits, inflation, supply chain challenges, and rising prices for fuel, services, construction, parts, and supplies are bringing more pressure to bear.

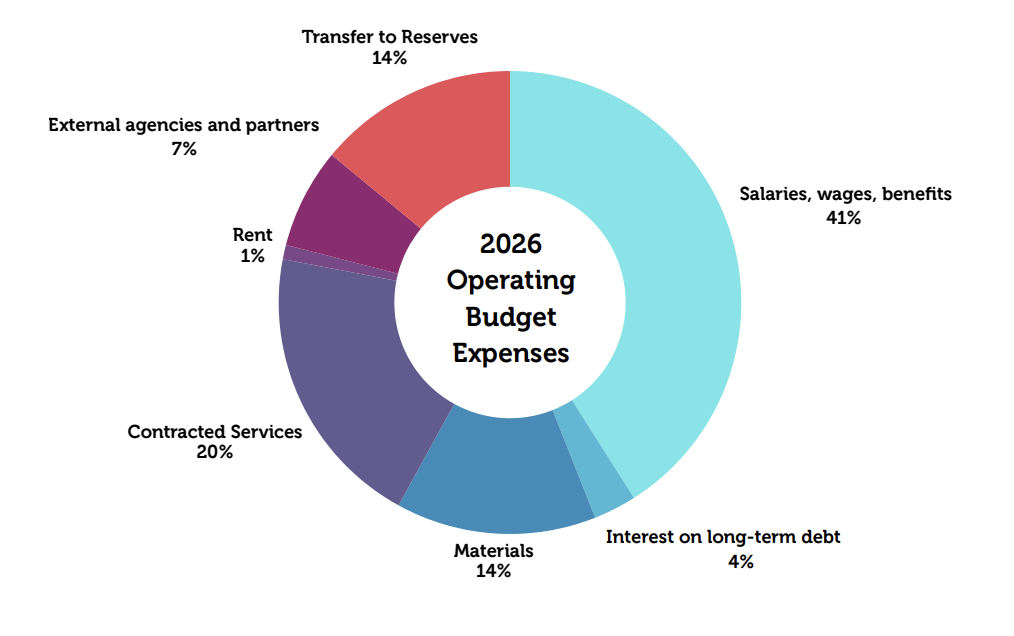

Staff salaries, wages and benefits make up 41 percent, or $24.6 million, of the total budget.

Contracted Services account for 20 percent, or $12 million, of the operating budget. Those include ambulance services, waste collection, and road and winter maintenance.

The County will pay $4.86 million for police services in 2026, an increase of 5 percent, or $272,000, over 2025.

Meanwhile, external agencies and partners make up 7 percent, or $4.2 million of the total budget. This figure includes transfers to the Prince Edward Lennox & Addington Social Services ($1,442,353), Quinte Conservation ($750,471) and Southeast Public Health ($675,294).

The total proposed 2026 municipal operating budget is $60.1 million, a $6 million increase over 2025. The capital budget is $30 million and combines tax supported ($22.7 million) and rate supported ($7.4 million) investments. All told, the municipality is seeking about $90 million from residents in 2026.

The book is forthright on the topic of the debt load.

“The County does not have a clear debt strategy. Instead, [it] relies on a mix of provincial and federal funding opportunities, updates to asset management plans, policy changes based on affordability pressures, and general cost-control efforts.”

The County has $71 million in outstanding debt — rising to $131 million in 2026. Shire Hall will pay about $6 million to service that debt in 2026, an increase of $1.5 million over 2025.

Driving much of the new debt is a $62.5 million construction loan for the $97 million Long Term Care facility to replace the HJ Macfarland Memorial Home. The municipality will eventually recoup most of that funding from the Ministry of Long Term Care — but the payback schedule is measured in decades.

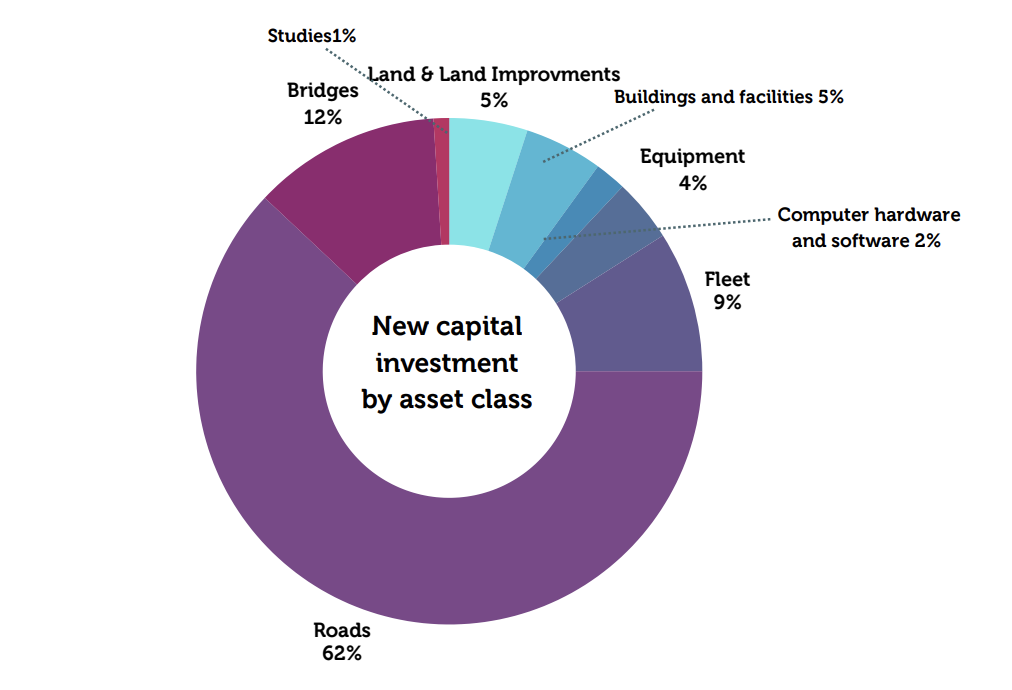

The provincially-mandated and Council-approved Asset Management Plan calls for significant investment into our cracked and crumbling roads.

Of the $22.6 million of direct investment into infrastructure build and renewal in 2026, 62 percent, or $14 million, is for roads.

After a robust public engagement exercise that helped form direction, Council voted to approve an AMP that would bring the average Pavement Condition Index (PCI) for County roads from 65 or “fair” to an overall PCI of 83, raising the County’s 1,100 km of roads to “very good” condition.

Other capital investments include the Barker Street ($3.9 million) and Bowery Street ($1.34 million) reconstruction projects, as well as work on County Road 3 ($3.1 million). Shire Hall is also setting aside $3 million for general rural road reconstruction projects. There is $2.1 million for the Outlet River bridge on County Road 18.

The AMP also requires maintaining the County’s 23 parks in “fair” or better condition.

Over the course of the year, community organizations and municipal departments make requests for consideration in the 2026 operating budget. These range from a $5,000 grant for the Krasyliv Friendship City Program to a $473,000 envelope for the Municipal Financial Relief Grants for low-income residents who have trouble paying their property taxes and water/wastewater bills.

The municipality added 30 part-time Personal Support Workers to the HJ Macfarland Memorial Home staffing matrix and launched a $10,000 Civic Recognition Awards program. These initiatives are slated to continue in 2026.

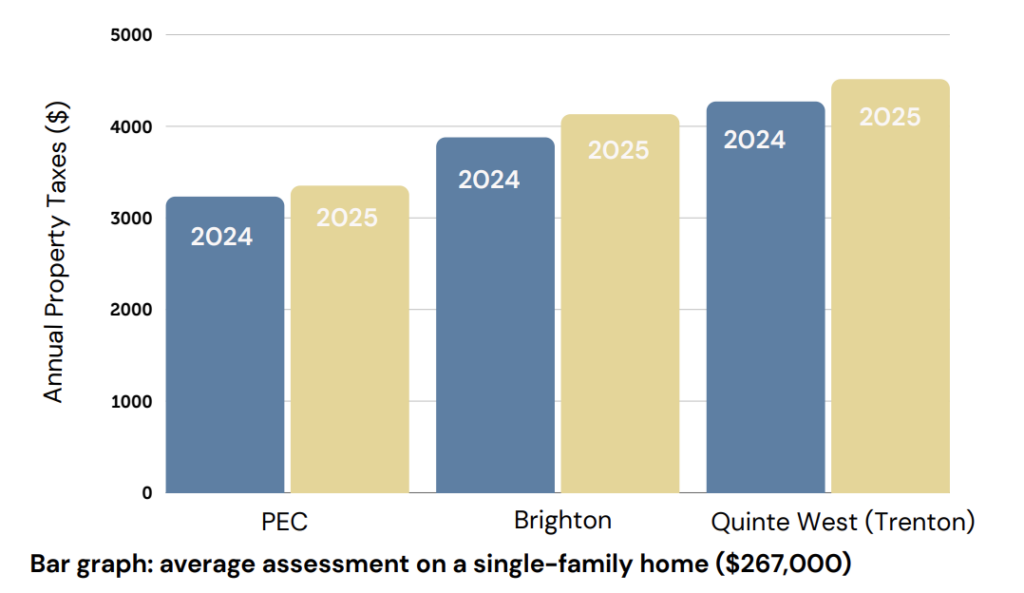

The book offers some comparable municipal tax rates. County residents pay lower property taxes than both Brighton and Quinte West. The average single family home in PEC is valued at $267,000, because MPAC is still assessing value at 2016 numbers.

According to the 2025 Census, the County’s property taxes represent 3.85 per cent of the average household income of $87,100. Brighton homeowners pay 5 percent based on average family income of $82,400. In Quinte West, the ratio is 5.5 per cent based on an average income of $81,600.

All are welcome to attend Council’s budget deliberations at Shire Hall Dec 1-3.

Monday, December 1 at 6 pm:

A summary presentation from the treasurer

Deputations and comments from the audience

Tuesday, December 2 at 9 am

Capital budget discussions

Wednesday, December 3 at 9 am

Operating budget discussions

Following the special Council meeting, staff will revise the draft budget based on Council discussions and public input. The final budget will come before Council for review and approval in January 2026.

See it in the newspaper